- The FCA has released an annual detailed report focusing on cryptocurrencies

- It lifts the lid on why people have bought in and why

- Will the number of coin owners keep growing?

Who is a typical crypto holder?

Around 1.9million Britons own cryptocurrencies, according to the new data from the FCA – or nearly 4 per cent of the adult population.

These are people who actually ‘own’ a coin in a wallet, not have their money tracking the price.

A further 700,000 people have also held crypto at some point, or 5.35 per cent of Britons – up 2.35 percentage points on a year earlier.

That means more than one in 20 Britons have been tempted into dabbling in crypto at some point.

What about the price?

The price of bitcoin soared from $1,000 a coin in early 2017 to $20,000 by the end of the year.

A year later, it had fallen to $3,000.

Last summer, it managed a spell back over $10,000 a coin, it fell back to $6,000 in March and currently sits at around $9,000.

According to the study, 78 per cent of all people had heard of bitcoin.

The next most familiar? Libra, which hasn’t launched, followed by bitcoin cash, ether, bitcoin SV and litecoin – these were the only ones with a 10 per cent or more familiarity with the British public.

The data, which was gathered in December 2019, also showed that people were far more likely to have heard of cryptocurrency: nearly three quarters are now aware of it, compared to just 42 per cent a year before.

What is the make-up of a typical punter and how much have they gambled of their own cash?

Well, 79 per cent are male, 69 per cent over the age of 35 and the majority – 73 per cent – are classed as being in the highest ABC1 social grades.

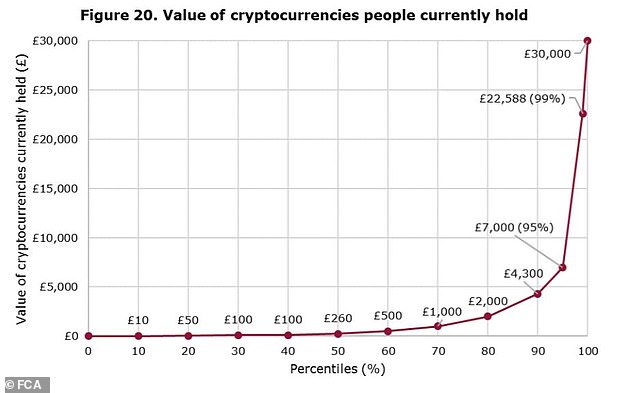

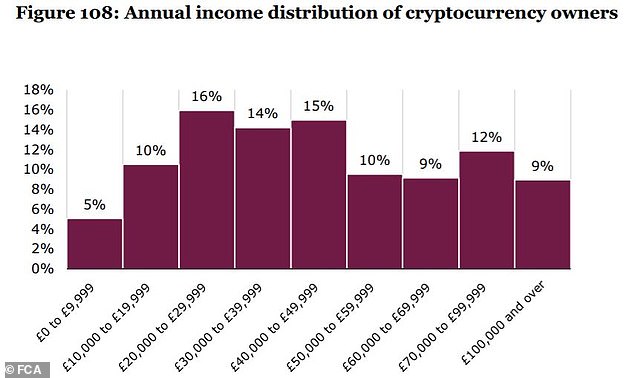

Furthermore, nearly half of cryptocurrency holders earn £20,000 to £50,000, with exactly half of all owners holding under £260 worth and 75 per cent under £1,000.

This suggests that most have dipped their toes in the market in the hope of a crypto like bitcoin rising to $100,000 a coin.

If you bought £260 worth today, and it did – for whatever reason – rise to $100,000 a coin, it would see the value rise to around £3,000 from that initial investment.

It is small enough for most to write it off if needed, but big enough to have more than a passing interest.

The most popular reason for consumers buying cryptocurrencies was as ‘as a gamble that could make or lose money’, acknowledging that prices are volatile.

There has also been a shifting generational change – just 7 per cent of all crypto holders were 55-plus in 2018. Despite seeing largely as a millennial or generation Z purchsae, this figure has increased to 22 per cent in the new study.

Meanwhile, the number of 18-24 year-olds involved dropped from 18 per cent to 10 per cent.

The most likely age range to hold crypto now is 35 to 44 year-olds at 27 per cent.

The year previous, 25-34 year-olds were most likely, at 39 per cent. The survey is of a nationally representative online panel of 3,085 respondents.

Some have borrowed money to get involved

In the survey, the FCA used the term cryptocurrency, but notes: ‘This term is more widely used in public domain than the broader “cryptoasset” term we tend to prefer’.

This highlights that the city watchdog would prefer it not to be described as a form of currency.

The survey indicated that 8 per cent of people borrowed the money from financial firms, friends and family, other sources or using a credit card or existing credit facility.

While this seems a low percentage, the FCA says this is still 215,000 people. For a speculative investment, that is a worrying figure.

It does point out, however, that those who did borrow money purchased small amounts – half bought less than £120 worth.

Another titbit from the survey is that fact that 27 per cent of people who bought crypto are in the C2DE social grade.

These are described as skilled manual workers, semi-skilled and unskilled manual workers, state pensioners, casual and lowest grade workers and unemployed with state benefits only.

The FCA concluded that those displaying a lack of basic knowledge and are unaware of the absence of regulatory protections are more likely to be in this social grade than the typical cryptocurrency owner.

On that note, most consumers seem to understand the risks associated with the lack of protections, the high volatility of the product and have some understanding of the underlying technology, the study says.

Nevertheless, the lack of such knowledge among some presents potential consumer harm – 11 per cent of current and previous cryptocurrency owners thought their money was protected.

Again, while the minority, it still amounts to approximately 300,000 adults.

Nearly half of people said they bought crypto as a gamble that could make or lose money. Just 15 per cent expected to make money quickly.

A quarter have bought in as a part of a wider investment portfolio, while a similar number said they did as they feared missing the boat.

Meanwhile, 17 per cent said they have got involved as they don’t trust the financial system and the same amount did as part of a long-term savings plan, such as a pension.

Never been used and use non-UK exchanges

According to the study, 47 per cent of people have never used cryptocurrency for anything.

This suggests that many are buying it and holding it in the hope of the value growing, not for any practical use.

Last month saw the announcement that PayPal will begin supporting bitcoin transactions – which may change all that.

The majority bought their crypto through an online exchange. Of those that used an online exchange, 83 per cent used non-UK based exchanges.

While there are plenty of reputable exchanges, as we’ve pointed out before, it can be the Wild West, with people potentially transferring their money overseas.

Coinbase is by far the most popular exchange to use – 63 per cent of those who have bought crypto used the San Francisco based firm.

The next four that most people use are Binance, based in Malta, Kraken, also in San Francisco, Bittrex in Seattle and Bitfinex, Hong Kong – the only other firms to score above 10 per cent.

Are they holding it for the long-term?

In general, cryptocurrency holders expect to hold onto it for long periods of time – again, highlighting that most are now buying and leaving it, in the hope for long-term growth.

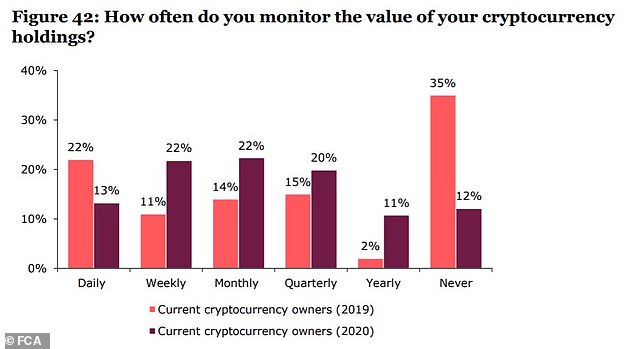

In the previous study, 35 per cent said they never monitored the value of their crypto holding – however, this has dropped to 12 per cent.

Most current owners who have a plan for how long they intend to hold crypto expect to keep them for three years or more.

At the same time, almost 40 per cent said they don’t know for how long they will hold onto it.

Have more people got involved during lockdown?

It is highly likely that the number of people involved in cryptocurrencies has surged during lockdown, thanks to stock market volatility, savings rates collapsing and having extra cash.

There have been plenty of reports suggesting that some households have managed to save extra cash – much of which has poured into savings accounts or National Savings and Investment products.

Some of this would have been diverted into bitcoin. On 11 May, in the midst of lockdown, we also saw bitcoin half – an event that happens every four years.

It means the reward for digitally mining Bitcoin has halved from 12.5 coins per block to 6.25, constricting the supply.

The event saw some exchanges report an influx of investors, hoping to see prices surge after the event.

According to Google Trends, worldwide searches for bitcoin reached their highest amount since the halcyon days of late 2017 and early 2018, when crypto chat became all the rage.

Crypto Gard Consultancy Conclusion

A managed account with Crypto Gard Consultancy will eliminate any concerns in the report above, we have the most advanced AI (Artificial Intelligence) Algorithms working 24/7 finding patterns in price movements and giving us the best signals of when to buy and when to sell a coin. Alongside our professional expert traders, combine the two and we have found a winning formula that has steered us well for over 2 years.

Millions of new people are starting to join the world of Crypto and we are at the forefront of the managed account industry.

We believe in Cryptocurrencies and we are excited about what the future will bring for our clients and our company.

If you have friends, family, work colleagues or know anyone who is thinking about buying cryptocurrencies, then please put them in touch with us, our recommend a friend promotion will give you an additional $200 that will be added to your deposited funds account for each and every recommendation that signs up for a Crypto Gard Consultancy Managed Account.

Leave A Comment